Sustainability in the EU: From Theory to Action

January 17, 2023

2022 has been a pivotal year for sustainability policy worldwide. In the EU, where sustainability regulation enjoys broad popular and institutional support, sustainability policy shifted from theory to action.

The European Commission has now defined the detailed contours of its sustainability framework – through the Taxonomy Regulation (TR), Sustainable Finance Disclosure Regulation (SFDR), Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CS3D) – and laid out the related disclosure templates and other implementing rules. Regulators will now shift their attention to supervision and enforcement. We briefly outline below the developments that will most affect companies that do business in the EU in 2023 – distinguishing between implementation challenges and possible future developments.

Defining and Aligning with ESG

Implementing EU Taxonomy Disclosures

The 2020 Taxonomy Regulation provided a first framework definition of “green” (i.e., environmentally sustainable) economic activities, to encourage sustainable investments and combat greenwashing.[1] The subsequent implementing acts set out sector-specific sustainability criteria for a number of “high impact” activities that are seen as key for the green transition (i.e., from transport and energy generation, to industrial manufacturing and raw material extraction).[2] Activities that fall under these criteria are called “Taxonomy-eligible.” The Taxonomy Regulation requires companies to disclose, for the first year, only the percentage ofTaxonomy-eligible activities that they carry out each year.

Starting in 2023 (with respect to the 2022 financial year), large non-financial issuers of EU-listed securities will be required to disclose their “Taxonomy-alignment”, i.e., the degree to which those “high impact” activities and investments are environmentally sustainable. The requirement will gradually extend to other types of companies: large financial sector firms (in 2024), all large EU firms (in 2026), and finally also EU-listed SMEs (in 2027).

The KPIs for measuring Taxonomy-alignment are specific to the type of company and sector.[3] For non-financial sector companies, they will concern the percentage of the company’s (i)turnover, (ii)capex and (iii)opex associated with Taxonomy-eligible activities.

Preparing for Taxonomy-alignment disclosures presents challenges. Securing access to sufficient, reliable ESG data remains complicated. KPIs for financial institutions – banks’ “green asset ratio” (GAR) for instance – were criticized for being both difficult to apply, and insufficiently representative of a bank’s effective financing of green versus brown activities. By way of example: credit granted in favor of smaller non-listed firms (that are not themselves in-scope of Taxonomy-alignment reporting obligations) may not count towards a bank’s GAR. Logically, this will result in a more favorable ratio for institutions whose lending activities focus on larger corporates.

Possible future Taxonomy Scenarios

This year, the Commission will work on sectoral environmental sustainability thresholds for the EU’s four remaining “green” objectives (pollution control, water use and marine resources, biodiversity and circular economy).[4] Their structure will presumably mimic what was done in 2022 for climate change mitigation and adaptation – which included the debated “green” classification of nuclear energy and natural gas.[5]

The Commission is also considering whether to extend the Taxonomy beyond just “green” to cover (i)“amber” activities, having an intermediate impact on environmental sustainability (such as nuclear and natural gas, but also grey and blue hydrogen) and (ii) “red” activities (such as coal-generated energy), having a detrimental impact. A separate category may also emerge for low environmental impact activities (such as professional services), which do not have the potential to significantly benefit nor harm the environment.[6]

Lastly, 2023 will see the development of a Taxonomy with respect to human rights and good governance (the “S” and “G” of “ESG”). On the “Social” end, the EU intends to protect the rights of (i) employees (focusing on decent work and workers’ rights), (ii) consumers (with a focus on healthy, safe and durable products, and on favoring products that improve citizens’ access to primary needs like quality food, water, housing and education), and (iii) communities affected by corporate activities (such as to promote broader equality and inclusive growth). As “Governance,” the Taxonomy is likely to look at both the good conduct of companies (e.g., board diversity and worker representation) and those of public affairs (anti-bribery and corruption, but also responsible lobbying, and transparent and non-aggressive tax planning). [7]

Disclosing on ESG

Delivering Transparency on Sustainability Risks & Impacts

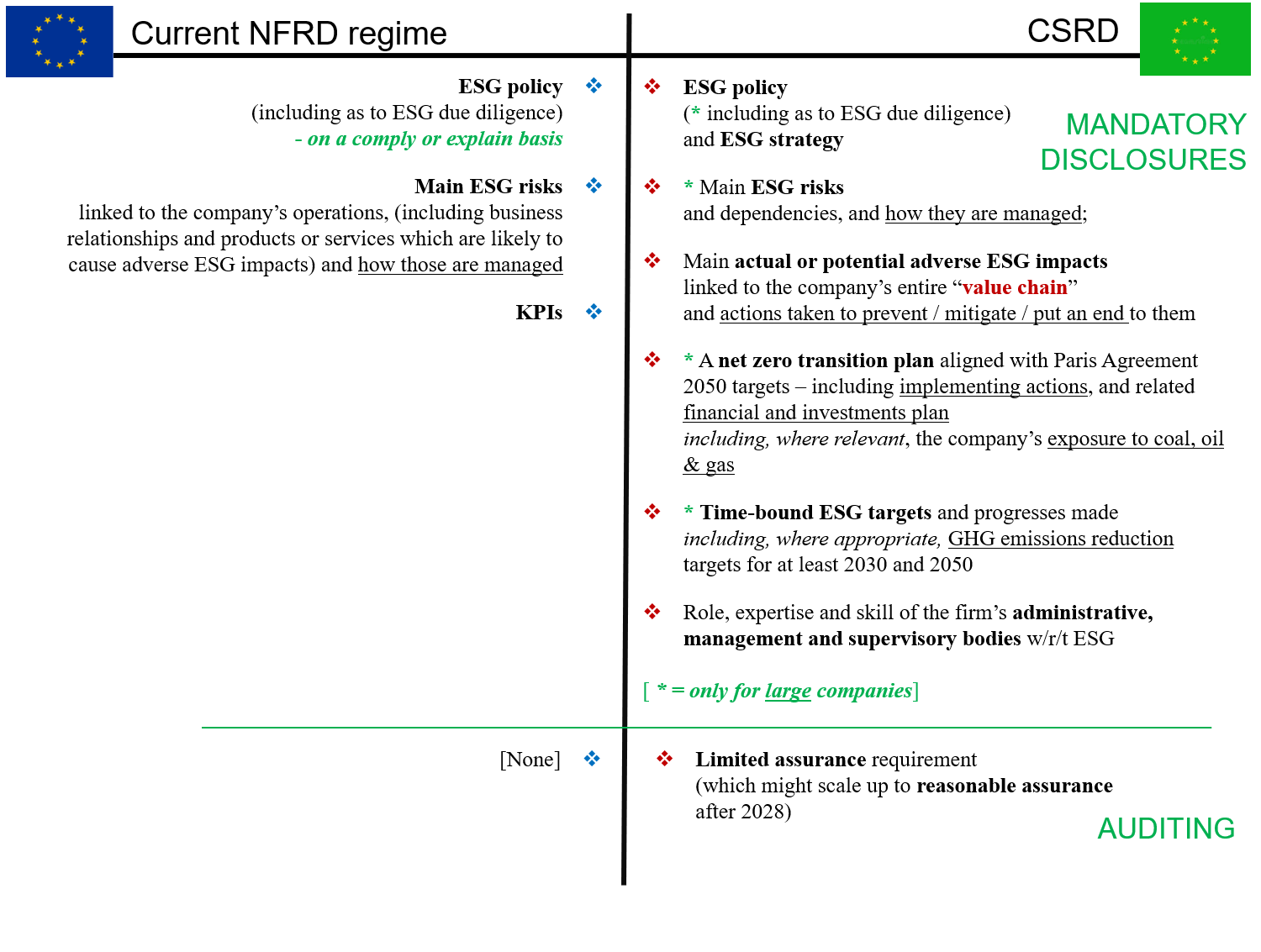

On November 28, 2022, the EU approved the text of its much awaited “Corporate Sustainability Reporting Directive” (CSRD).[8] The CSRD will have a phased-in application, starting (in 2025) with the 2024 FY reports of large financial sector companies and listed issuers. The regime represents a profound overhaul of the “Non-Financial Reporting Directive” (NFRD) rules that have applied since 2017 to European “public interest entities.”

Importantly, the CSRD extends EU reporting rules beyond EU companies and will also apply (starting in 2029) to the parent companies of multinational groups headquartered outside of the EU where these generate over €150 million of consolidated revenues within the Union.[9]

Another area of attention in the months to come relates to CSRD implementing rules and standards. Last November, the EU Financial Reporting Advisory Group (EFRAG) delivered a first set of draft sustainability reporting rules which the Commission is set to approve by June of this year. These rules set out the details of what and how companies should report under the new regime.[10] An additional set of sector-specific standards will be formulated by EFRAG in the course of 2023.

Similar considerations apply to asset managers’ disclosures under the Sustainable Finance Disclosure Regulation’s (SFDR) new implementing rules, which have become applicable since January 1, 2023. While the Commission, the EU financial market supervisor (ESMA) and national regulators have released multiple set of Q&As and guidance in response to queries by regulators and market participants over the course of the past months, a certain lack of regulatory clarity remains.

Future Evolutions of ESG Disclosure Rules

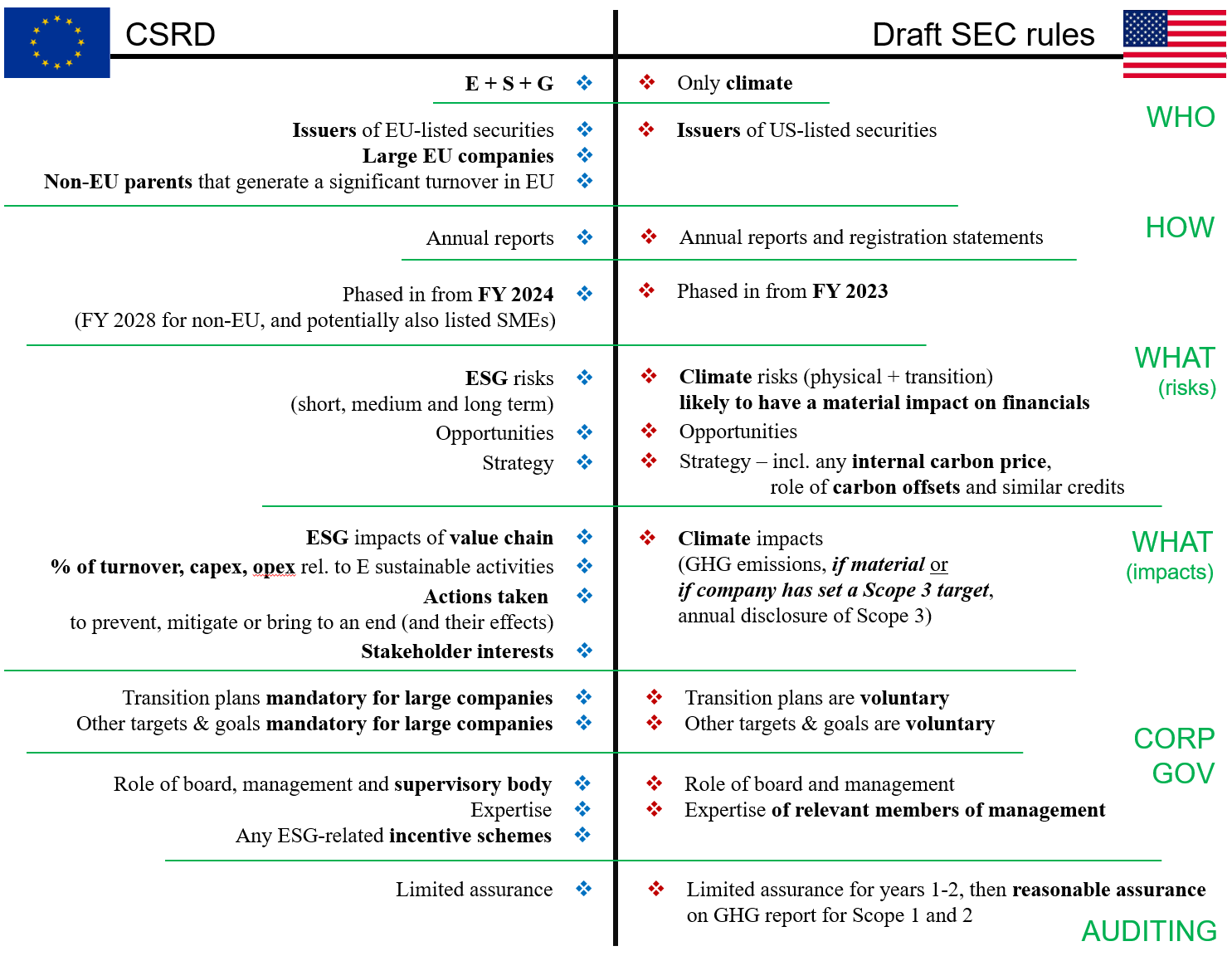

While the EU took a head-start on ESG disclosure rules in 2021, other regulators and international bodies, including the U.S. Securities and Exchange Commission (SEC) have worked to catch up. Assuming that the SEC publishes final climate-related disclosure rules early this year, many companies operating on both sides of the Atlantic Ocean will potentially need to begin preparing for compliance with both EU and U.S. rules.[11]

For one thing, EU rules cover a wider spectrum, given their focus on E+S+G – as opposed to only climate change – and on “double materiality” (i.e., risks & impacts) – as opposed to only “financial materiality” (i.e., the financial risks that the company faces as a result of climate change). It is therefore somewhat uncertain whether and in what measure the EU’s anticipated “equivalence decisions” will bring any relief to U.S. issuers that are due to report under both frameworks.

2023 will then see the emergence of the reporting standards of the ISSB. Although voluntary in nature, these are being drafted in coordination with global regulators (including EFRAG) and it is expected that they will set a common baseline that may generally guide and shape global market practice and (potentially) also supervisory enforcement.[12]

A second development for 2023 will certainly be a marked growth in supervisory and enforcement action in the ESG disclosure space. ESMA in particular, has indicated that it considers common enforcement in the area of sustainability disclosures as a priority for 2023, and aims to ensure effective and harmonized action by national competent authorities, particularly with respect to greenwashing.[13] Supervisory and enforcement actions could leverage on similar actions carried out in other jurisdictions, causing spill-over effects for multinational firms.

Lastly, the Commission is considering whether to regulate the activities of ESG rating and data providers.[14] Rulemaking in this space could follow the principles used to regulate credit rating agencies (that is, seeking to ensure methodological integrity rather than regulate content). Increasing the reliability of ESG-related data would certainly be welcome by both issuers and investors, since this data is a key element underpinning the accuracy and credibility of sustainability disclosures generally.

Acting on ESG

Creating an Accountability Regime for Negative ESG Impacts

Finally, the EU set off to create harmonized, EU-wide duties for companies to prevent, mitigate and remediate any material negative impacts of their activities on the environment and human rights. Some EU Member States – notably France and Germany – in fact already have similar regimes in place of their own. [15]

It has now been almost one year since the publication of the Commission’s proposal for a “Corporate Sustainability Due Diligence Directive” (CS3D).[16] Under the CS3D, companies will be expected to monitor and act upon any material negative ESG impacts of their activities, as well as (potentially) the activities of their subsidiaries, business partners, suppliers, and other “established business relationship,” both upstream and downstream, direct and indirect: a surprisingly wide net captured by the concept of “value chain.”

Companies in scope of the CS3D will be required to adopt adequate corporate governance arrangements and internal policies. This is expected to include publicly accessible “grievance mechanisms” and stakeholder consultations on remedies. Similarly to the CSRD, large non-EU companies operating in Europe might be caught by the rules.

In parallel, the Commission issued two other ESG supply chain due diligence-related proposals that, unlike the CS3D, would operate as blanket bans on the circulation of affected goods.

The first is a “Deforestation Regulation” that (if approved) would block all EU imports and sales of cattle, cocoa, coffee, palm oil, soya and wood, plus certain derived products (such as chocolate, furniture, leather, printed paper products, swine, sheep, goats and poultry meat, maize and rubber), requiring distributors to ensure that their supply chains are entirely deforestation-free.[17]

The second and most recent is the so-called “Forced Labour Ban,” affecting any product whose fabrication (including the fabrication of individual components) has involved, at any point, forced labour.[18] The proposal was drafted in the context of rising international pressure to address the supply and sale of products made with forced labour – marked in particular by the issuance of the U.S. “Uyghur Forced Labour Prevention Act,” in December 2021.[19]

Some Take-aways

Regulatory pressure on ESG matters is rising in the EU, leading companies to rethink fundamental aspects of their governance, supply chain, disclosure, compliance and risk management strategies.

In parallel, activists and NGOs are relying on laws and regulations (such as the French Corporate Duty of Vigilance Law) to push companies to not only increase disclosures on ESG, but also to reshape their business strategies, with the aim of forcing a stronger and faster alignment with the goals of the Paris agreement. Therefore in 2023, as the ESG framework continues to expand and deepen, companies will need to navigate increasingly complex and sometimes contradictory requirements, under an increasing threat of litigation and enforcement, creating new and unique challenge for management and board members.

[1] The EU Taxonomy Regulation is available here. For our analysis of the Taxonomy framework, see our November 2020 alert memo available here.

[2] The sector-specific sustainability criteria issued so far can be consulted through the “Taxonomy Compass” digital tool, available here.

[3] The Taxonomy “delegated acts” laying out the various Article 8 KPIs are available here.

[4] As required under Paragraph 5 of Articles 12, 13, 14 and 15 of the Taxonomy Regulation.

[5] For an analysis of the nuclear & gas “Complementary Delegated Act,” see our February alert memo available here.

[6] The “Extended Environmental Taxonomy Report” (March 2022) of the Platform for Sustainable Finance is available here. See our April alert memo available here.

[7] The Platform’s “Report on a Social Taxonomy” (February 2022) of the Platform for Sustainable Finance is available here. See our March alert memo available here.

[8] The official text of the CSRD (as published in the EU Official Journal in December 2022) is available here. For an analysis of the original Commission proposal, see our May 2021 alert memo available here.

[9] A recent interview of one of Cleary’s Associates concerning the final version of the Directive – and in particular, its enlarged “extra-territorial scope” – is available here.

[10] EFRAG’s draft standards (as transmitted to the Commission for approval) are available here.

[11] For further discussion, see Prepared for Climate? A Director’s Readiness Guide and our April 2022 alert memos available here.

[12] The ISSB committed to an “early 2023” release date, in a press release made at COP27 and available here.

[13] See ESMA’s enforcement priority statement of October 28, 2022 (available here) and its most recent annual work programme (available here).

[14] The Commission’s first summary report on its public consultation on the ESG ratings market (August 2022) is available here.

[15] France approved its landmark Corporate Duty of Vigilance Law (Loi de Vigilance) in 2017. For Germany, the Supply Chain Act, passed in 2021, entered in force at the start of this year. For a comparative analysis of national supply chain due diligence regimes, see our January 2021 alert memo available here. For an analysis of the German Supply Chain Act, see our January 2022 blog post available here.

[16] The latest available draft of the CS3D (the EU Council’s “general approach” of December 1, 2022, is available here. For a commentary of the Commission’s original CS3D proposal of February 2022, see our March alert memo available here.

[17] The Deforestation Regulation proposal of November 2021 is available here.

[18] The Labour Ban proposal of September 2022 is available here.

[19] The “Uyghur Forced Labour Prevention Act” is available here. Unlike its American counterpart, the EU ban is not focused on a specific area of provenance of goods and their components, nor does it reverse the burden of proof on importers.