Cleary Dominates in YTD LatAm Bonds Issuances

October 13, 2016

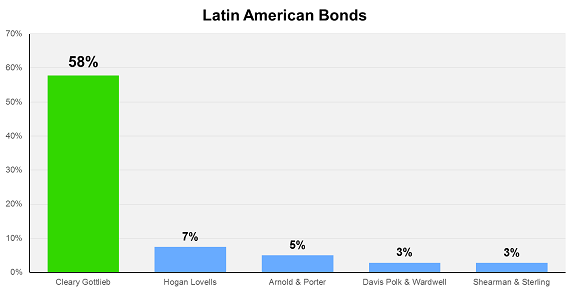

For the first nine months of 2016, Cleary Gottlieb led all international law firms in Latin American bond issuances, achieving a total market share of 58 percent during the period, according to Bloomberg.

Cleary’s work in the region leads in both deal count (40 issuances) and volume (over $46 billion), each figure representing at least a five-fold increase over the second-ranked legal advisors in the respective categories.

According to Bloomberg, the firm also ranked in the global top five by volume for both issuer’s and underwriter’s counsel for bond issuances.

Cleary’s strong presence as counsel to issuers in Latin America includes:

Argentina

- The Republic of Argentina in various financings that permitted the closure of the holdout “pari passu” litigation related to the sovereign’s restructuring, including debt offerings totaling over $19 billion. These debt offerings, which included liability management transactions, marked the sovereign’s return to the international capital markets after a 15-year absence.

- Petrobras Argentina in its $500 million debt offering and $300 million concurrent cash tender offer, which were a prerequisite for the closing of Pampa Energia’s acquisition of the company. Cleary also advised Pampa in the acquisition financing.

- Three Argentine provinces in their international debt offerings totaling over $2.7 billion:

- Province of Chaco in its $225 million debut international debt offering.

- Province of Buenos Aires in its $1.25 billion Rule 144A/Reg S debt offering and $1 billion 144A/Reg S debt offering.

- Province of Neuquen in its $235 million Rule 144/Reg S debt offering and concurrent exchange offer.

Brazil

- The Federative Republic of Brazil in its SEC-registered $1.5 billion bond offering. This marked the first time Cleary has acted as counsel to the sovereign in the international capital markets.

- Petrobras in its $6.75 billion bond offering and $3 billion bond reopening and concurrent liability management transactions.

- Suzano Austria and Suzano Papel e Celulose in a $500 million debt offering.

- Vale in debt offerings totaling over $2.25 billion, marking its return to the capital markets after a four-year absence.

Chile

- The Republic of Chile in its $1.35 billion and €1.2 billion debt offerings and concurrent secondary trade tender offer.

- Gildemeister in a $700 million exchange offer to restructure the company’s debt.

Dominican Republic

- The Dominican Republic in its Rule 144A/Reg S bond offerings totaling over $1.5 billion.

Mexico

- Pemex in its $4 billion Rule 144A/Reg S debt offering and concurrent $1.6 billion tender and exchange offers.

- The Mexico City Airport $2 billion green bond, the largest-ever green bond in Latin America.

- América Móvil in its €1.5 billion SEC-registered debt offering.

Uruguay

- The Republic of Uruguay in numerous bond offerings in 2016 with an aggregate value of over $2.8 billion.