Sustainability Reporting

January 17, 2024

EU Corporate Sustainability Reporting Directive

After several years during which the EU’s Corporate Sustainability Reporting Directive (CSRD) had been hotly discussed and anticipated, 2023 saw not only the entry into force of the CSRD itself,[1] but also the adoption and publication of the European Sustainability Reporting Standards (the ESRS).[2]

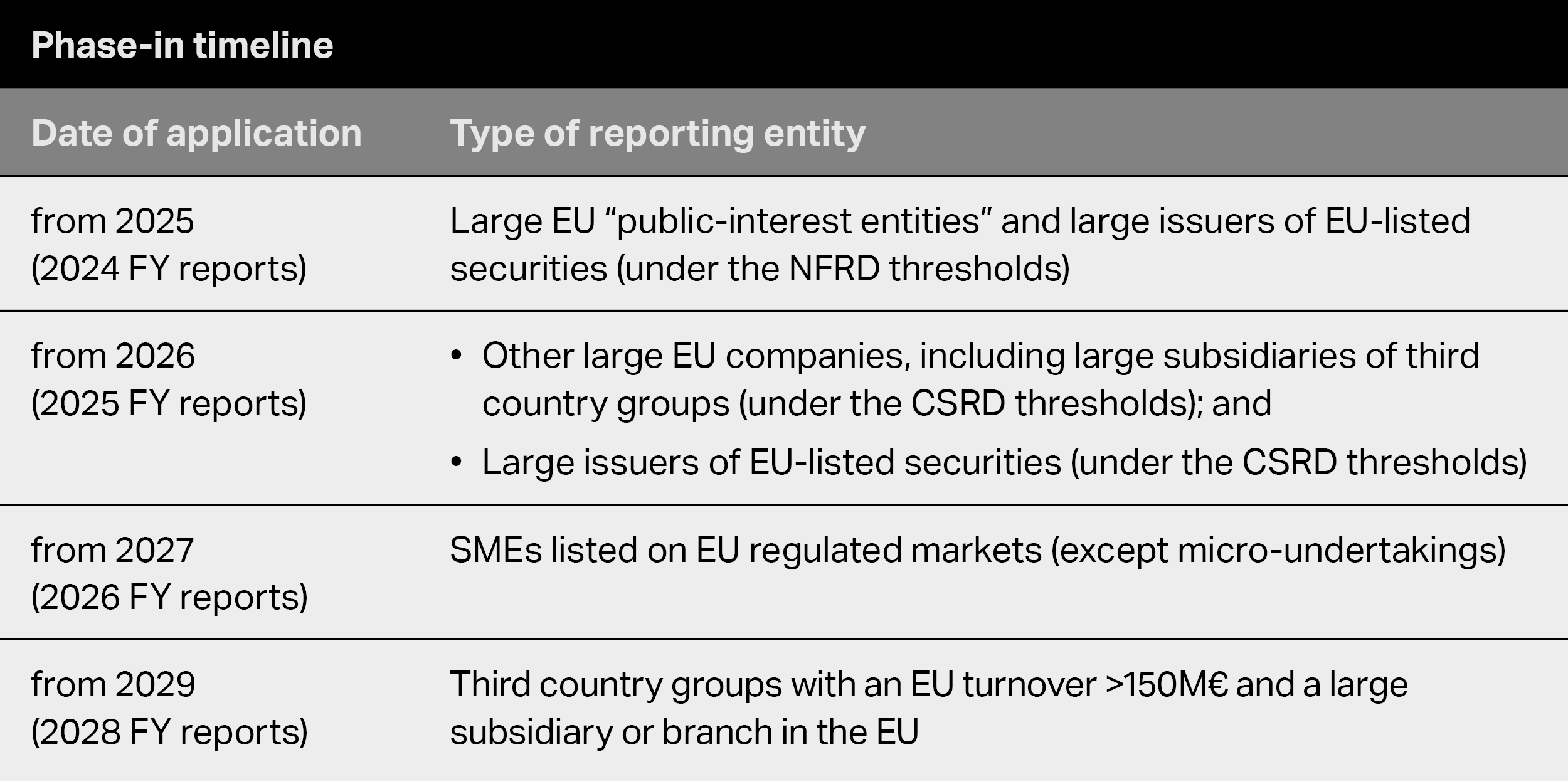

2024 marks the start of the phase-in of the new reporting requirements, with the first CSRD compliant reports being required to be published by large EU-based “public-interest entities” in respect of financial years starting on or after 1 January 2024:

Groups that may be subject to CSRD should therefore carry out a mapping exercise to determine which EU and non-EU companies are in scope and the timing and manner in which they will comply with the disclosure requirements (e.g. at entity level, sub-consolidated level or consolidated group level).

International trends

While the CSRD’s requirements stand out from the landscape of international reporting requirements – not least because the broad scope of sustainability matters to be reported, the EU’s “double materiality” perspective, and the mandatory disclosure of Paris-Agreement-aligned transition plans – there are a number of international developments that Boards should continue to monitor.

One of these is the international regulatory uptake of the International Sustainability Standards Board’s (ISSB’s) IFRS S1 and IFRS S2 standards,[3] published in June last year. The UK, for example, has already confirmed its intention to base its future sustainability disclosure standards on the ISSB framework.[4] 2024 will also likely see the finalisation of the US Securities and Exchange Commission’s climate disclosure rules.

Another trend to watch is the increasing focus on nature- and biodiversity-related disclosures. In September 2023, the Taskforce on Nature-related Financial Disclosures published its disclosure recommendations,[5] and it is expected that this topic will assume increasing importance over this year in the minds of both standard-setters such as the ISSB as well as regulators.

EU Taxonomy

The EU Taxonomy Regulation[6] provides a framework definition of environmentally sustainable economic activities to promote sustainable investment and combat greenwashing. Subsequent implementing acts set sector-specific sustainability criteria for a number of “high impact” activities that are considered key to the green transition, and specify the content and presentation of information to be disclosed on environmentally sustainable economic activities, as well as the methodology to comply with this disclosure obligation.

For the purposes of the EU Taxonomy Regulation, an economic activity is considered to be environmentally sustainable or “aligned” if it meets all of the following requirements:

- It substantially contributes to one or more of the six environmental objectives of the EU Taxonomy Regulation in accordance with certain technical standards: (i) climate change mitigation; (ii) climate change adaptation; (iii) sustainable use and protection of water and marine resources; (iv) transition to a circular economy; (v) pollution prevention and control; and (vi) protection and restoration of biodiversity and ecosystems;

- It does not significantly harm any of the other environmental objectives; and

- It is carried out in compliance with certain minimum safeguards.

For the first two objectives, climate change mitigation and climate change adaptation, non-financial undertakings[7] were required to disclose their Taxonomy-alignment for the first time in 2023. Financial undertakings[8] will be required to disclose that Taxonomy-alignment from 2024. Gradually, more EU companies will be required to comply with the EU Taxonomy Regulation requirements, in line with the phased approach of the CSRD.[9]

In June 2023, the European Commission adopted:

- The Amended EU Taxonomy Climate Delegated Act[10] to broaden the scope of economic activities that contribute to climate change mitigation and adaptation (i.e. the first two objectives), including in the manufacturing and transportation sectors; and

- The EU Taxonomy Environmental Delegated Act[11], which establishes a new set of EU Taxonomy criteria for economic activities that make a substantial contribution to the four remaining objectives.

Beginning January 1, 2024, in scope companies will be required to disclose their percentage of Taxonomy-eligible activities with respect to these new criteria and activities. Disclosure of Taxonomy-alignment in line with theses delegated acts will be required from 2025 for non-financial undertakings and from 2026 for financial undertakings.

Similar to CSRD, companies should be monitoring the Taxonomy regulations to determine if and when their activities may be reportable.

Mandatory Sustainability Due Diligence

On February 23, 2022, the European Commission published a legislative proposal for a Directive on Corporate Sustainability Due Diligence (“CS3D”),[12] aimed at promoting sustainable and responsible corporate behavior and integrating human rights and environmental considerations into companies’ operations and corporate governance.

As a result of inter-institutional negotiations, the European Parliament and the Council reached a provisional agreement on December 14, 2023. The provisional agreement must now be approved and formally adopted by both institutions before it can enter into force.

Under the provisional agreement,[13] companies will have to, among other things:

- Integrate due diligence into their policies and risk management systems;

- Adopt a plan to ensure that their business model complies with limiting global warming to 1.5°C;

- Identify, assess, prevent, mitigate, end and remedy their negative impacts and those of their upstream and downstream partners;

- Engage meaningfully with those affected by their actions;

- Establish a complaints mechanism;

- Communicate on their due diligence policies; and

- Monitor the effectiveness of their due diligence policies and measures on a regular basis.

The CS3D will apply to EU companies with more than 500 employees and a net worldwide turnover more than €150 million, non-EU companies with a turnover generated in the EU of more than €150 million, and to smaller EU and non-EU companies in high-risk sectors such as the manufacture of textiles, clothing and footwear, agriculture, mineral resources and construction. Financial services will initially be excluded from the scope of the CS3D, but there will be a review clause for a possible future inclusion.

Each EU Member State will designate a supervisory authority to monitor firms’ compliance with the due diligence requirements and will have the power to conduct inspections and investigations and to impose sanctions on non-compliant firms, including “naming and shaming” and fines of up to 5% of their worldwide net turnover.

Civil liability will also be available to victims of companies that fail to meet their due diligence obligations.

The CS3D is expected to be adopted in early 2024, with a two-year period from the date of entry into force for Member States to implement it into national law, so the C

Greenwashing – Turing up the Heat

A topic that should be considered carefully by Boards in 2024 is greenwashing.

So far, much of the focus in respect of greenwashing has been on regulators’ trying to formulate clear expectations for businesses within their regulatory remit. For example, in June last year, the European Supervisory Authorities (ESMA, EBA, EIOPA) published progress reports on greenwashing, setting out their current thinking on greenwashing and related risks in their respective sectors.[14]

It is likely, however, that over the course of 2024, efforts to tackle greenwashing will increase, as a result of legislative efforts as well as litigation.

The European Commission has already proposed (i) amendments to the Unfair Commercial Practices Directive and the Consumer Rights Directive with the aim of “empowering consumers for the green transition through better protection against unfair practices and better information”;[15] and (ii) a new Directive on substantiation and communication of explicit environmental claims.[16] Both instruments are expected to be adopted in the course of 2024. Greenwashing risk, particularly in respect of past statements, is also heightened by increasing disclosure requirements (e.g., those imposed by the CSRD).

Independently from these legislative developments, 2023 has already seen a drastic increase in greenwashing litigation and other enforcement action making it into the headlines. Actions have been brought in Europe, for example in the Netherlands,[17] and a claim challenging the validity of carbon-credit based carbon-neutrality claims was upheld in the Düsseldorf Regional Court in Germany.[18] That greenwashing claims can, in principle, give rise to civil liability in courts was shown several years ago by the class action brought by Altroconsumo against VW before the Court of Venice.[19] In France, the case against TotalEnergies for greenwashing based on misleading commercial practices under the French Consumer Code is progressing on the merits, as the Paris Judicial Court ruled in May 2023 that the three NGOs (Greenpeace France, Amis de la Terre France and Notre Affaire à Tous) had standing to bring their case.[20]

Other Regulatory Developments

In addition to the above developments, Boards should be aware of the vast range of other ESG-related regulatory developments in the EU. A few highlights:

- Towards the end of 2024, the majority of the EU’s new Regulation on deforestation-free products[21] will begin to apply;

- 2024 may see the adoption of the EU’s proposed forced labor ban;[22]

- A number of key initiatives under the EU’s Circular Economy Action Plan are expected to progress significantly. Amongst other things, the overhaul of the EU’s eco-design framework (including the introduction of a new digital product passport) is expected for 2024;[23] in the batteries space, not only will the majority of requirements under the new Batteries Regulation[24] begin to apply, but the proposed Critical Raw Materials Act[25] will likely be adopted and the Commission has also announced that it would set up a EUR 3 billion fund to support the European batteries industry.[26] Other important initiatives to monitor relate to the proposed “right to repair” as well as the new requirements applicable to packaging and packaging waste, which could have impacts across a broad range of industries;

- Lastly, 2024 will likely see the creation of a new framework for the regulation of ESG ratings.[27]

Litigation – Some highlights

France

Duty of Vigilance Law

Pursuant to France’s “Duty of Vigilance Law”, adopted in 2017, a company may be given a formal notice to publish a vigilance plan in accordance with the Duty of Vigilance Law, which should explain what measures the company has implemented to identify and prevent human rights and environmental violations associated with the company’s activities. If the company does not comply with the formal notice within a period of three months, the competent court (or the president of the court acting in summary proceedings) may, at the request of any person justifying an interest, order the company to comply with such obligations and may impose penalty payments for this purpose.

The Duty of Vigilance Law anticipates in many respects on the CSRD and CS3D and litigation under this law could offer a preview of possible actions under these EU frameworks.

In 2023, the Paris Judicial Court issued its first decision on the merits in a case involving the La Poste Group. The Paris Judicial Court ordered La Poste Group to: (i) complete its vigilance plan with a risk map identifying and prioritizing risks; (ii) establish procedures to assess subcontractors based on specific risks identified in the risk map; (iii) supplement its vigilance plan with a mechanism for alerting and collecting reports after consulting representative unions; and (iv) adopt and publish measures for the monitoring vigilance measures. This decision could pave the way for similar decisions in the future.

Given the number of pending cases,[28] other decisions are expected in 2024 that will likely further clarify the scope of the duty of vigilance for companies pending the adoption and subsequent implementation of the CS3D into national law.

Criminal complaints

In 2023, far-reaching criminal complaints were filed in connection with the protection of the environment. By way of example, on September 22, 2023, four NGOs sued TotalEnergies for four alleged criminal offences: abstention from fighting a disaster, involuntary manslaughter, involuntary personal injury, and destruction or damage to the property of others likely to cause danger to persons. While TotalEnergies has denied these allegations, the NGOs seek to demonstrate that TotalEnergies had the opportunity to take action to combat climate change by limiting its investments in the fossil fuel sector, but instead continued to develop new oil and gas infrastructure, thereby contributing to the aggravation of a crisis that endangers a large part of the world’s population.

Germany

German Supply Chain Due Diligence Act

On 1 January 2023 the German Supply Chain Act (Lieferkettensorgfaltspflichtengesetz) came into effect. While the Act initially applied to German-based companies with more than 3,000 employees, since 1 January 2024, Companies with more than 1,000 employees per average per fiscal year in Germany (including in affiliated companies) came into scope. The Act will likely be amended when the EU introduces CS3D.

The Act imposes on German companies[29] extensive due diligence compliance obligations with regard to human rights and environmental protection along the supply chain. More specifically, in-scope companies are required to adopt certain policies and processes related to supply chain due diligence (including in respect of risks connected to indirect suppliers), implement preventative measures and complaint procedures, conduct risk analyses, provide remedial action in the event of a human rights violation, document and report on the fulfilment of its due diligence obligations, and review the efficacy of their policies and processes at least annually as well as on an ad hoc basis. Notably, the Act establishes a duty of effort, but not an obligation of result. As such, in-scope companies must prove they have done everything they can to prevent human rights-related risks along the supply chain under the “principle of adequacy”, resulting in the obligation for the companies to use reasonable best efforts.

The Federal Office of Economics and Export Control (“Bundesamt für Wirtschaft und Ausfuhrkontrolle” or BAFA) is responsible for monitoring and enforcing the Supply Chain Act. In 2023, approximately 40 complaints in total were filed with BAFA under the Act. Reportedly, only in six cases did BAFA actually contact the relevant companies, and it has not, so far, imposed any sanctions under the Act. While BAFA itself does not provide information about specific cases, it has further been reported that NGOs filed complaints against German food retailer Edeka and Rewe for alleged breaches of the Act.[30] Further complaints were filed by trade unions and NGOs: one against Tom Tailor, Amazon and IKEA in April 2023[31] for allegedly failing to adequately monitor conditions in their factories and endangering the safety of workers; and another against Volkswagen, BMW and Mercedes-Benz in June 2023[32] for alleged human rights violations in their supply chains in the Xinjiang Uygur Autonomous Region.

Litigation in relation to the German Climate Protection Act

The 2021 Neubauer et al. v. Germany ruling[33] by the German Constitutional Court led to a review of the German Climate Protection Act, as some parts of it were not in line with the targets set for reducing greenhouse gas emissions by 2030. The ruling also led to a significant increase in the number of civil cases brought by NGOs and individuals seeking to force polluting companies to change their climate-related policies and use of internal combustion engines. Since then, car manufacturers in particular have been sued for their impact on climate change, including Volkswagen,[34] Mercedes-Benz[35] and BMW.[36] However, a number of these cases were dismissed in 2022 and 2023 by German courts, which found that the companies either complied with their regulatory obligations or that there was insufficient evidence that the plaintiffs’ individual rights were threatened.

UK

In the UK, a claim that, over 2023, was the focus of much attention in this area was ClientEarth’s claim against Shell, which was based on the allegation that Shell’s directors had failed to properly take into account the implications for the company of the economy’s net-zero transition, and, thereby, had breached some of their directors’ duties. The claim was ultimately unsuccessful.[37]

[1] Official Journal of the European Union, “Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting” (December 16, 2022), available here.

[2] Official Journal of the European Union, “Commission Delegated Regulation (EU) 2023/2772 of 31 July 2023 supplementing Directive 2013/34/EU of the European Parliament and of the Council as regards sustainability reporting standards” (December 22, 2023), available here.

[3] For additional information on IFRS, see our July 2023 alert memo available here.

[4] U.K. Department for Business and Trade, “UK Sustainability Disclosure Standards” (August 2, 2023), available here; U.K. Financial Conduct Authority, “Primary Market Bulletin 45” (August 10, 2023), available here.

[5] Taskforce on Nature-related Financial Disclosures, “Recommendations of the Taskforce on Nature-related Financial Disclosures” (September 2023), available here.

[6] Official Journal of the European Union, “Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088” (the “EU Taxonomy Regulation”) (June 22, 2020), available here.

[7] A non-financial undertaking is an undertaking that is subject to the disclosure obligations laid down in Articles 19a and 29a of the Accounting Directive and is not a financial undertaking (Article 1(9) of the Disclosures Delegated Act).

[8] A financial undertaking is an undertaking that is subject to the disclosure obligations laid down in Articles 19a and 29a of the Accounting Directive and is an asset manager, a credit institution, an investment firm, an insurance undertaking or a reinsurance undertaking (Article 1(8) of the Disclosures Delegated Act).

[9] The EU Taxonomy Regulation applies inter alia to “undertakings which are subject to the obligation to publish a non-financial statement or a consolidated non-financial statement pursuant to Article 19a or Article 29a of the Accounting Directive, respectively” (Article 1(c)). As such, the entry into force of the CSRD has an impact on the scope of application of the EU Taxonomy Regulation.

[10] Official Journal of the European Union, “Commission Delegated Regulation (EU) 2023/2485 of 27 June 2023 amending Delegated Regulation (EU) 2021/2139” (November 21, 2023), available here.

[11] Official Journal of the European Union, “Commission Delegated Regulation (EU) 2023/2486 of 27 June 2023” (November 21, 2023), available here.

[12] European Commission, “Proposal for a Directive on corporate sustainability due diligence and annex” (February 23, 2022), available here.

[13] European Parliament News, “Corporate due diligence rules agreed to safeguard human rights and environment” (December 14, 2023), available here; European Council of the European Union, “Corporate sustainability due diligence: Council and Parliament strike deal to protect environment and human rights” (December 14, 2023), available here.

[14] European Securities and Markets Authority, “Progress Report on Greenwashing” (May 31, 2023), available here; European Banking Authority, “EBA Progress Report on Greenwashing Monitoring and Supervision” (May 31, 2023), available here; European Insurance and Occupational Pensions Authority, “EIOPA Advice to the European Commission on Greenwashing” (June 1, 2023), available here.

[15] European Commission, “Proposal for a Directive of the European Parliament and of the Council amending Directives 2005/29/EC and 2011/83/EU as regards empowering consumers for the green transition through better protection against unfair practices and better information” (March 30, 2022), available here; the European Parliament and the Council of the European Union reached a political agreement on October 25, 2023, available here.

[16] European Commission, “Proposal for a Directive of the European Parliament and of the council on substantiation and communication of explicit environmental claims (Green Claims Directive)” (March 22, 2023), available here.

[17] Sabin Center for Climate Change Law, “FossielVrij NL v. KLM” (2022), available here.

[18] Sabin Center for Climate Change Law, “Deutsche Umwelthilfe v. TotalEnergies Warme & Kraftstoff Deutschland GmbH“ (2022), available here.

[19] Sabin Center for Climate Change Law, “Altroconsumo v. Volkswagen Aktiengesellschaft and Volkswagen Group Group Italia S.p.A.“ (2016), available here.

[20] Greenpeace France, “Assignation Devant Le Tribunal Judiciaire de Paris” (March 2, 2022), available here (in French language) and here (unofficial English translation).

[21] Official Journal of the European Union, “Regulation 2023/1115 of the European Parliament and of the Council of 31 May 2023” (June 9, 2023), available here.

[22] The Commission proposal for a regulation prohibiting products made with forced labour on the Union market is accessible here.

[23] European Commission, “Proposal for a Regulation of the European Parliament and of the Council establishing a framework for setting ecodesign requirement for sustainable products and repealing Directive 2009/125/EC” (March 30, 2022), available here.

[24] Official Journal of the European Union, “Regulation 2023/1542 of the European Parliament and of the Council of 12 July 2023” (July 28, 2023), available here.

[25] European Commission, “Proposal for a Regulation of the European Parliament and of the Council establishing a framework for ensuring a secure and sustainable supply of critical raw materials and amending Regulations (EU) 168/2013, (EU) 2018/858, (EU) 2018/858, 2018/1724, and (EU) 2019/1020” (March 16, 2023), available here. For an analysis of the proposed regulation, see our firm’s dedicated alert memo, accessible here.

[26] European Commission, “Commission proposes one-off extension of the current rules of origin for electric vehicles and batteries under the Trade and Cooperation Agreement with the UK” (December 6, 2023), available here; European Commission, “Proposal for a Council Decision as regards the transitional product-specific rules for electric accumulators and electrified vehicles” (December 6, 2023), available here.

[27] European Commission, “Proposal for a Regulation of the European Parliament and of the Council on the transparency and integrity of Environmental, Social, and Governance (ESG) rating activities” (June 13, 2023), available here. For an analysis of the proposed regulation, see our June 2023 alert memo, available here.

[28] According to publicly available information, the cases currently pending before Paris Judicial Court or Paris Court of Appeal:

- TotalEnergies (greenhouse gas emissions; protection of people and the environment in the context of oil projects in Uganda and Tanzania);

- EDF (respect of indigenous peoples’ rights in the context of a wind farm project in Mexico);

- Rocher Group in relation to (freedom to join a union and discriminations against women with respect to a Turk subsidiary);

- Suez (right to water in Chile);

- Casino (deforestation, indigenous’ rights abuses and forced labor in Brazil and Colombia);

- Danone (inadequate acknowledgement and management of plastic pollution); and

[29] Companies regardless of legal form having their head office, principal place of business, administrative headquarters, statutory registered office or branch office in Germany.

[30] Spiegel Economy, “Oxfam files complaint against Edeka and Rewe” (November 3, 2023), availablehere.

[31] Due Diligence Design, “First case filed under the German Supply Chain Due Diligence Act against Tom Tailor, Amazon, and IKEA by Bangladeshi workers” (April 27, 2023), available here.

[32] Due Diligence Design, “Second case filed under the German Supply Chain Due Diligence Act” (July 6, 2023), available here.

[33] Climate Case Chart, “In the proceedings on the constitutional complaints of individuals from Germany against the failure of the Federal Republic of Germany to adopt suitable statutory provisions and measures to tackle climate change” (March 24, 2021), available here.

[34] Sabin Center for Climate Change Law, “Kaiser et al v. Volkswagen AG” (2021), available here; Sabin Center for Climate Change Law, “Allhoff-Cramer v. Volkswagen AG” (2021), available here.

[35] Sabin Center for Climate Change Law, “Deutsche Umwelthilfe (DUH) v. Mercedes- Benz AG” (2021), available here.

[36] Sabin Center for Climate Change Law, “Deutsche Umwelthilfe (DUH) v. Bayerische Motoren Werke AG (BMW)” (2021), available here.

[37] For additional information on the High Court reaffirming the decision against Shell’s board, see our July 2023 alert memo available here; For additional information on Client Earth’s order to pay Shell’s costs after the dismissal of the derivative claim against Shell’s board, see our September 2023 alert memo available here.