Benelux FDI: Luxembourg FDI Screening Regime Enters Into Force

September 5, 2023

Investments in Luxembourg entities closed after September 1, 2023—including those signed beforehand—will need to factor in potential FDI filings in the Grand Duchy.

The Luxembourg FDI law establishes a mandatory screening system for non-EEA investments made on a lasting basis in legal entities incorporated in Luxembourg and carrying out critical activities. Luxembourg follows in the footsteps of its Benelux counterparts that introduced new FDI regimes in the past two months.[1]

The FDI Law

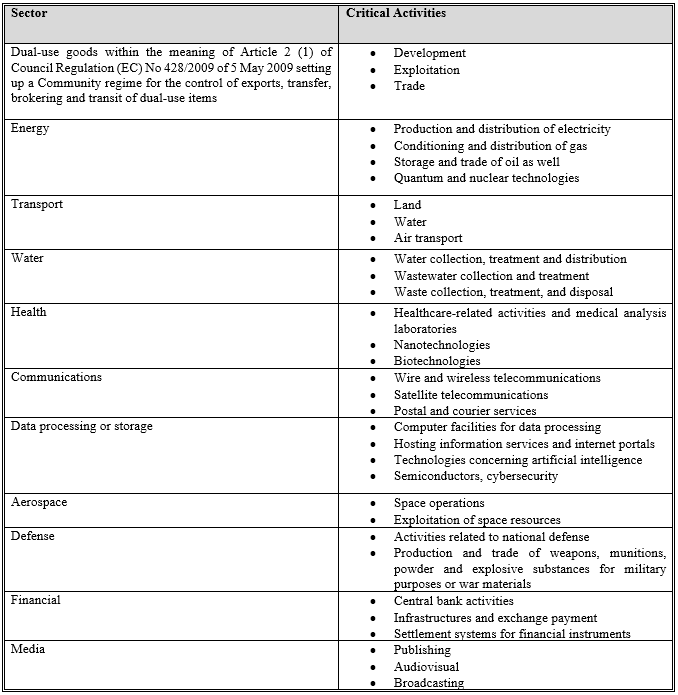

The FDI Law applies to investments made by a non-EEA investor in a legal entity incorporated in Luxembourg that is active in any of the following “critical areas”:[2]

Table: Critical activities as per Article 2 of the FDI Law:

The FDI Law does not introduce any value-based thresholds or de minimis exceptions.

Investments Covered

The FDI Law covers investments by non-EEA persons allowing the investor to effectively participate in the “control” of a Luxembourg incorporated entity carrying out a critical activity. This includes joint acquisitions or investments through third parties, provided that the investment creates a long-lasting link with the Luxembourg entity. The FDI Law defines “control” as one or more of the following:

- holding directly or indirectly at least 25% of the share capital in the Luxembourg entity;

- holding a majority of the voting rights in a Luxembourg entity;

- to be a direct or indirect shareholder of a Luxembourg entity and having the right to appoint or remove the majority of the members of the administrative, management or supervisory body of that entity; or

- to be a shareholder or partner of a Luxembourg entity and to control, by means of agreements among shareholders or partners of the Luxembourg entity, the majority of voting rights in that entity.

The FDI Law explicitly excludes from its scope “portfolio investments” which do not meet the above thresholds, defined as “acquisition[s] of securities made with the intention of making a financial investment, without acquiring control of the Luxembourg entity”.

Notification and Review

Mandatory ex ante notifications. Reportable transactions are subject to a mandatory pre-closing notification by the foreign investor to the Luxembourg Ministry of Economy (“MoE”). Notifications need to be made before the implementation of an investment. It is not entirely clear whether the standstill obligation applies during a Phase I review or is only triggered upon a Phase II review being opened; pending further guidance from the authority, it may be prudent not to close an investment pending clearance or receipt of an explicit confirmation from the authority.

Notifications require information about the transaction structure and timing, the foreign investors’ ultimate beneficial owners, the value and financing of the investment, the products, services and commercial operations of the foreign investor and the Luxembourg entity, as well as the countries in which they carry out their commercial operations.

Review timeline. Phase I review is triggered once the MoE confirms that the filing is complete and lasts 2 months, subject to ‘stop-the-clocks’ in case of RFIs.

Within the MoE, the notifications are reviewed by an inter-ministerial committee, supported by a group of experts. Based on their recommendation, the MoE and the Ministry of Finance (“MoF”) decide jointly whether to subject a foreign investment to a screening procedure i.e., a Phase II review. Phase II lasts additional 2 months, subject to ‘stop-the-clocks’ in case of RFIs.

Substantive review. The FDI Law sets out a number of factors to be taken into account in determining whether the FDI is capable of affecting Luxembourg’s national security or public order, notably impact on:

- critical infrastructure or their continued operations;

- supply of essential inputs including raw materials and food safety;

- access to, or the ability to control sensitive information; and

- the freedom and pluralism of the media.

The investor risk criteria focus on whether the foreign investor (i) is directly or indirectly controlled by a third country public entity, (ii) has already participated in activities capable of affecting national security or public order in another EU Member State, or (iii) is likely to engage in criminal activities.

Decisions and Sanctions

Decisions. Any decision on the approval or prohibition of a foreign investment is adopted by the MoE and MoF based on the opinion of the inter-ministerial committee. Decisions may be subject to one or more conditions.

Sanctions. Failure to file or closing without approval may be subject to a potential unwinding or modification order, while failure to implement prescribed conditions could result in the revocation of the authorization and an unwinding or modification order. In addition, the authorities could impose administrative fines of up to €1 million for individuals and up to €5 million for companies.

International Perspective

Luxembourg is the last Benelux country to introduce a mandatory foreign direct investment regime, following the Dutch and Belgium counterparts doing so in the past two months. Luxemburg is the 21st EU Member State to join the EU FDI control framework, while Estonia, Croatia, Greece, Ireland, Sweden, and Bulgaria are expected to do so in due course.

[1] See: “Dutch Foreign Direct Investment Screening Regime Enters Into Force” (Cleary Gottlieb, July 4, 2023); “FDI Screening Mechanism Now Active in Belgium” (Cleary Gottlieb, July 13, 2023).

[2] The FDI Law also includes “linked activities” likely to (i) allow access to sensitiv