CMA Publishes Update on Its Initial Review Into AI Foundation Models

April 25, 2024

On 11 April 2024, the CMA published an update paper (the Update Paper) in relation to its initial review of AI Foundation Models (FMs).

An accompanying technical update report (the Technical Update Report) was published on 16 April 2024, providing further detail on market developments and feedback from stakeholder engagement. These updates follow the CMA’s September 2023 initial report into the same topic (the Initial Report).

Summary

Although the CMA recognizes that large technology firms have been “drivers of innovation in this space,”[1] it is “concerned that the FM sector is developing in ways that risk negative market outcomes.”[2] In the words of the CMA CEO, Sarah Cardell:

“When we first started this work, we were curious. Now, with a deeper understanding and having watched developments very closely, we have real concerns.”[3]

The Update Paper identifies three “key risks”[4] and suggests ways the CMA might mitigate these:

- First, the CMA suggests that incumbent firms may restrict access to critical inputs for developing FMs to shield themselves from competition. The CMA is investigating this issue in its Phase 2 market investigation into cloud services. It also comments that it will “[examine] the competitive landscape in AI accelerator chips”[5] as part of its next phase of work in the initial review.

- Second, the CMA claims that incumbent firms could exploit their positions in consumer or business facing markets to distort choice in FM services. The CMA proposes to tackle this through its new powers in the proposed new UK digital regime under the Digital Markets, Competition, and Consumers Bill (DMCC Bill), expected to enter into force this later year. For example, it suggests “critical access points or routes to market for FM deployment,”[6] such as productivity software and mobile ecosystems, as priority areas for Strategic Market Status (SMS) designations under the new regime.

- Third, the CMA is considering whether partnerships involving key players could reinforce or extend existing positions of market power through the value chain. The CMA has identified 90 strategic partnerships and investments involving Google, Amazon, Microsoft, Meta, Apple and Nvidia (which it coins the “GAMMAN” firms).[7] It plans to monitor such partnerships closely, especially in relation to important inputs, firms with strong market positions, and FMs with “leading capabilities.”[8] The CMA also plans to “step up” its use of merger control to examine whether such partnerships give rise to competition concerns.[9] It is currently inquiring whether to launch merger control reviews into Microsoft’s partnerships with OpenAI and Mistral AI, Microsoft’s hiring of former employees at Inflection AI, and Amazon’s partnership with Anthropic.

The CMA plans to publish a further update on its AI-related work in Autumn 2024, and, among other initiatives, it has announced a forthcoming paper on the role of AI accelerator chips in the FM value chain.

Background

The CMA claims that it has observed several significant developments since it published its Initial Report last year:

- Varying use of generative AI. The CMA cites research by Ofcom—the UK communications watchdog—that only 31% of adults, but 79% of 13-17-year-olds, have used a generative AI tool. It also references ONS data, which indicates that around 15% of UK businesses are currently using at least one form of AI.[10]

- Rapid increase in FMs available publicly. The CMA describes the ongoing proliferation and diversification of AI tools—it observes that over 120 FMs have been released between the publication of the Initial Report and March 2024, raising the overall number of FMs available globally to over 330.[11] In the Technical Report, the CMA explains that stakeholders have also noted an increasing diversification of FMs across size, input and resource requirements, levels of performance and specialization.[12]

- Reliance on the availability of compute, data and expertise. The CMA cites access to AI accelerator chips, computing resources via the cloud, data and talent as central to FM development,[13] claiming that large technology companies typically have greater access to these resources, and that FM developers are accessing data through partnerships, investments, and licensing deals. The CMA describes a “battle for talent” among firms to attract technical expertise.[14] This comes in the light of a series of high-profile hires by tech firms, such as Microsoft’s close ties with OpenAI’s Sam Altman and recent hire of DeepMind Co-founder Mustafa Suleyman. On 24 April 2024, the CMA announced that it is investigating Microsoft’s hiring of former employees at Inflection AI.

- Increase in monetization and integration of FMs. The CMA observes that FMs are being released on a range of platforms and are integrated in an increasing number of products, such as productivity software and social media, as the FM market evolves towards greater monetization.[15] It lists Microsoft’s integration of Copilot into Windows and Microsoft 365 as one example. The CMA predicts that future integration of FMs into digital products may involve autonomous AI.[16]

- Interconnected value chain. The Update Paper comments that the FM value chain is becoming more interconnected thanks to vertical integration, partnerships and strategic agreements between firms, with the “largest and most established technology firms” becoming increasingly active across multiple levels of the value chain.[17]

Updated Guiding Principles for Firms

In light of the developments above, the CMA “urge[s]” firms across the FM value chain to align their business practices with its six guiding principlesfor “responsible” development of the market. The CMA introduced the guiding principles in its Initial Report.[18] The principles have now been updated to emphasize the CMA’s concern to monitor “powerful partnerships” and mitigate against alleged entrenchment. The confirmed principles are:[19]

- Access. Firms should ensure ready and ongoing access to key inputs (e.g.,data, compute, expertise and capital) without undue restrictions. Powerful partnerships and integrated firms do not reduce others’ ability to compete.

- Diversity. There should be sustained diversity of business models, including both open and closed source models.

- Choice. There should be sufficient choice for businesses and consumers so they can decide how to use FMs. For example, firms should be able to choose from a range of deployment options, such as in-house FM development, partnerships, APIs, or plug-ins. They should have flexibility to switch or use multiple FMs according to need (e.g.,through interoperability at all levels of the FM value chain).

- Fair dealing. Firms should not engage in anti-competitive conduct, such as self-preferencing, tying, or bundling. Vertical integration and partnerships are not used to insulate firms from competition.

- Transparency. Developers and deployers should give consumers and businesses the right

information about the risks and limitations of FM-generated content so that they can make informed choices. - Accountability. Firms at all levels of the FM value chain take responsibility for the development of a competitive market and take positive action to ensure consumers are adequately protected.

The CMA’s Concerns in Detail

Although the CMA recognizes that today’s largest technology firms are likely to play an important role in the development of FM-related markets, it says it is concerned that the sector is developing in ways that “could risk negative market outcomes.”[20] In the CMA’s view, the presence of a small number of incumbent firms that have market power in digital markets could shape FM markets “to the detriment of fair, open, and effective competition,”[21] and this risks harming businesses and users by “reducing choice, and quality, and by raising prices.”[22] The CMA’s three areas of concerns adopt classical antitrust theories: (i) input foreclosure; (ii) leveraging strong positions in adjacent markets; and (iii) partnerships between firms with strong positions.

- The CMA claims that firms could restrict access to critical inputs to shield themselves from competition. The CMA explains that firms could restrict access to important inputs to prevent other firms from building competitive FMs that challenge their own (or their partners’) FMs, and/or protect their position in related markets, by making it harder for rivals in those markets to develop or deploy FMs. It suggests that this behavior could reinforce incumbents’ positions in related markets by preventing the development of a “next generation competitive alternative,” reducing choice and quality, or increasing prices.[23] The CMA is investigating these issues as part of its ongoing investigation into cloud services markets, its review of the competitive landscape in AI accelerator chips,[24] and its current four merger inquiries into AI-related partnerships. The CMA also intends to use its new powers under the DMCC Bill to take account of developments in FM-related markets.

- The CMA suggests that incumbents could exploit their powerful positions to distort choice in FM services and restrict competition in FM deployment. The CMA is concerned that consumers’ and business’ choices of FM products they use could be shaped by the products they currently use and the way that FMs are integrated in those products. The CMA recognizes the potential innovation and efficiency benefits that such integrations bring, but it is concerned about the possibility of reducing consumer choice and the ability of downstream rivals to compete.[25] It states that firms who control important inputs, access points and routes to market could give themselves or their partners a competitive advantage through pre-installation, technical bundling, accessibility, integration and compatibility.

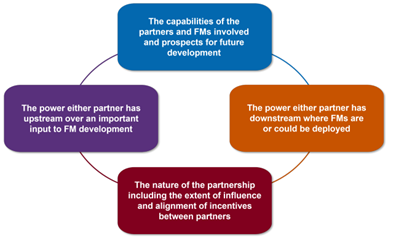

- The CMA is considering whether partnerships could reinforce or extend existing market power through the FM value chain. The Update Paper puts emphasis on the increasing number of partnerships, strategic investments and hires in the FM value chain involving the biggest firms across digital markets. The CMA recognizes that partnerships are part of the “development and investment ecosystem in the technology space,”[26] and may bring about pro-competitive benefits, but it is concerned that the incumbent position of certain firms in the market may give them “significant leverage” when agreeing partnerships that could be used to “quash competitive threats.”[27] To protect against this, the CMA is monitoring current and emerging partnerships closely, and states it is “stepping up” its use of merger control tools to examine whether such arrangements may be subject to review.[28] Firms can therefore expect close CMA scrutiny of investments in, or arrangements with, AI companies, even absent acquisitions of control.[29] The Update Paper sets out some of the “indicative factors” that the CMA will consider, which may trigger greater concern and attention to AI partnerships in a merger control review:[30]

Source: CMA, Update Paper, Figure 6

The CMA also continues to assess consumer protection issues in relation to FMs. It notes that FMs can “facilitate unfair consumer practices” through subscription traps, hidden advertising, fake reviews, developing new ways of acting unfairly, or inadvertently due to “hallucinations or flaws” in the technology.[31] The CMA is currently “building [its] understanding of how consumer protection issues might map on to AI-based products and services”[32] and it is exploring consumers’ understanding and use of FM services through cooperation with other members of the Digital Regulation Cooperation Forum (DCRF).

Next Steps

The Update Paper shows that the CMA is dialing up its scrutiny of AI, with the apparent aim of addressing anti-competitive practices while ensuring growth and innovation are not thwarted.

The CMA recognizes that unduly heavy-handed intervention carries risks: the Update Report warns of “chilling effects”[33] on competition if interventions by regulators are too burdensome and recommends that any policy interventions by governments should be “targeted and proportionate” and “should not come at the expense of diversity and choice which are also critical to resilience.”[34]

The CMA has set itself a busy agenda in the AI space, with the following milestones expected in the near future:

- A forthcoming paper on AI accelerator chips, considering their role in the FM value chain;

- Joint research with DRCF of consumers’ use and understanding of FM services, and participation in the DCRF AI and Digital Hub pilot;

- A joint statement with ICO concerning the interaction between competition, consumer protection and data protection in FMs;

- A response to UK government AI White Paper setting out CMA’s strategic approach to AI; and

- A further update on CMA’s work in Autumn 2024.

The CMA is also currently probing whether to open merger control investigations into Microsoft’s partnerships with OpenAI and Mistral AI, Microsoft’s hiring of former employees at Inflection AI and Amazon’s partnership with Anthropic.[35]

Please see the initial alert memorandum, here.

[1] CMA, Update Paper, para 5.

[2] CMA, Update Paper, para 3.

[3] Sarah Cardell, Opening remarks at the American Bar Association Chair’s Showcase on AI Foundation Models (April 11, 2024).

[4] CMA, Update Paper, para 20.

[5] CMA, Update Paper, para 34.

[6] CMA, Update Paper, para 41.

[7] CMA, Update Paper, para 43.

[8] CMA, Update Paper, para 47.

[9] CMA, Update Paper, para 14.

[10] CMA, Update Paper, para 9.

[11] CMA, Update Paper, para 11.

[12] CMA, Technical Update Report, para 3.30.

[13] CMA, Update Paper, para 14-17.

[14] CMA, Update Paper, para 17.

[15] CMA, Update Paper, para 19.

[16] CMA, Update Paper, para 20.

[17] CMA, Update Paper, para 22.

[18] CMA, Initial Report, para 7.2.

[19] CMA, Technical Update Report, para 4.1.

[20] CMA, Update Paper, para 47.

[21] CMA, Update Paper, para 28.

[22] CMA, Update Paper, para 28.

[23] CMA, Update Paper, para 31.

[24] A forthcoming paper will consider their role in the FM value chain. The CMA is expected to publish this in Q2/3 2024.

[25] CMA, Update Paper, para 37.

[26] CMA, Update Paper, para 18.

[27] CMA, Update Paper, para 45.

[28] CMA, Update Paper, para 47.

[29] The CMA has broad discretion in asserting jurisdiction over mergers that may affect a UK market. This includes acquisitions of “material influence” (where the acquirer can directly/indirectly materially influence policy relevant to the behavior of the target, regardless of its level of controlling interest). In Farfetch/YOOX Net-A-Porter/Richemont, the CMA found that Richemont would have the ability to exercise material influence over Farfetch in the context of acquiring a maximum of approximately 5-10% of Farfetch’s voting rights based on factors such as Richemont’s status and role as an important supplier and customer of Farfetch’s business.

[30] CMA, Update Paper, para 48.

[31] CMA, Update Paper, para 51.

[32] CMA, Update Paper, para 51.

[33] CMA, Update Paper, para 58.

[34] CMA, Update Paper, para 58.

[35] The CMA is inviting parties to submit views on Microsoft/Mistral AI, Microsoft/Inflection AI and Amazon/Anthropic by 9 May 2024.