New HSR Filing Fees, Transaction-Size Thresholds Coming in February

January 27, 2023

January 27, 2023

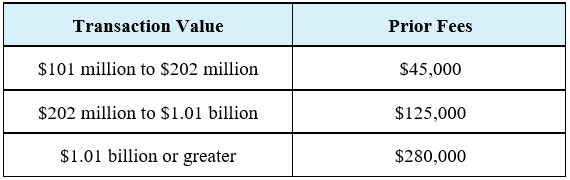

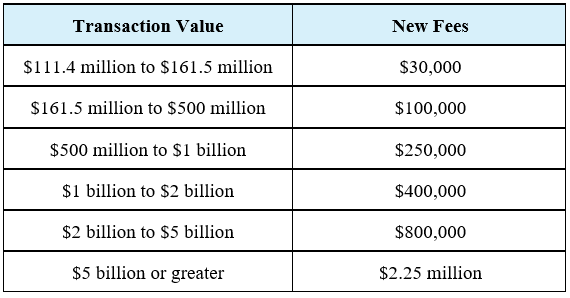

The recently-passed reconciliation act changed the filing fee structure for merger control filings in the United States under the Hart-Scott-Rodino (HSR) Act.

Meanwhile, the FTC has announced the annual adjustments to the HSR thresholds and to the dollar limits for the safe harbors relating to the prohibition of interlocking directorates of Section 8 of the Clayton Act.

The fees and thresholds will be adjusted annually. This new law results in much higher fees for all deals over $1 billion. For example, the fee on a transaction valued in excess of $5 billion will increase by 800% from $280,000 to $2.25 million.

The FTC also published the transaction-size thresholds. For transactions closing on or after February 26, 2023, the basic size-of-transaction threshold will be $111.4 million. These thresholds are also adjusted annually.

The thresholds for the de minimis exemption under Clayton Act Section 8’s prohibition against interlocking directorates are also being adjusted. The exemption now applies if the combined “capital, surplus, and undivided profits” of each company are below $45,257,000 (the prior threshold was $41,034,000) or if aggregate sales in which the corporations compete are less than $4,525,700 (the prior threshold was $4,103,400). The exemptions that apply if competitive sales are (2) less than 2% of either corporation’s total sales, or (3) less than 4% of each corporation’s total sales are unchanged.

Please contact one of the individuals listed above or any of your regular contacts at the Firm if you have any questions about these changes. For our blog post on the tax that these new filing fees could be viewed as placing on merger activity, please follow this link.