SEC’s Final Climate-Related Disclosure Rules: A Closer Look at the Climate Note to Audited Financial Statements

April 9, 2024

On March 6, 2024, the U.S. Securities and Exchange Commission approved in a 3-2 vote final rules that require most reporting companies to provide certain climate-related information in their registration statements and annual reports filed with the SEC.

This memorandum summarizes a portion of the final rules, the amendments to Regulation S-X, as amended (Regulation S-X), under the Securities Act of 1933, as amended (the Securities Act), and the Securities Exchange Act of 1934, as amended (the Exchange Act), that require a new footnote in audited financial statements, analyzes some of the key challenges these requirements may impose and concludes with some general takeaways. This memorandum does not address the GHG emissions and attestation report disclosure requirements or the governance, business, risk and targets disclosure requirements set forth in the final rules’ amendments to Regulation S-K, as amended (Regulation S-K), under the Securities Act and Exchange Act.

As predicted, multiple legal challenges to the final rules have been filed, starting almost immediately after the release of the final rules. Because challenges were filed in multiple circuit courts, the Eighth Circuit was selected by lottery to decide all of the related petitions. Although the petitioners are different, many of the challenges make similar claims, including that the SEC lacked authority to adopt the final rules, the adoption of the final rules violated the Administrative Procedures Act and the final rules would violate the First Amendment.

On April 4, 2024, the SEC instituted a voluntary stay of implementation of the final rules pending resolution of the various petitions challenging the final rules that are now before the Eighth Circuit. In its order issuing the stay, the SEC explained that though it still intends to vigorously defend the final rules’ validity, the stay would facilitate orderly judicial resolution of the challenges and allow the Eighth Circuit to focus on the merits (instead of the emergency stay motions) while also avoiding “potential regulatory uncertainty if registrants were to become subject to the [final rules’] requirements during the pendency of the challenges to their validity.” In light of the SEC’s stay order, registrants need not comply with the final rules’ disclosure requirements unless and until the Eighth Circuit finds that they were validly adopted. We note, however, that if the Eighth Circuit finds that the final rules were validly adopted before the compliance dates set forth in the adopting release, the SEC might not modify those dates. This will depend on a number of factors, including but not limited to how close to the compliance date the Eighth Circuit issues its decision and whether any party seeks to appeal to the Supreme Court. While registrants should continue to follow the developments in the legal challenges, given the uncertainty we think it is prudent to prepare for implementation of the final rules on the timeline of compliance dates laid out in the adopting release.[1]

I. Amendments to Regulation S-X

A. Introduction

The final rules create a new Article 14 of Regulation S-X requiring a registrant to include specific climate-related financial disclosure in the notes to its audited financial statements.[2] Regulation S-X contains requirements for financial statements that are included in registration statements, periodic reports and other filings under the Securities Act and the Exchange Act. Article 14 applies regardless of whether the registrant uses the forms for domestic issuers (e.g., Form 10-K) or for foreign private issuers (e.g., Form 20-F),[3] and regardless of whether the registrant uses U.S. GAAP or IFRS. It does not apply to interim financial statements. Because disclosures under Article 14 will be located in the audited financial statements, they will be subject to audit by the registrant’s independent public accountants and will fall within the scope of the registrant’s internal control over financial reporting (ICFR).

As initially proposed, Article 14 would have required registrants to disclose financial impact metrics from severe weather events and other natural conditions and transition activities on a line-item by line-item basis, as well as expenditures metrics relating to activities to mitigate climate-related risks and transition activities, in each case subject to a 1% threshold. In response to numerous comments highlighting the difficulties and high costs registrants would face implementing the proposed rules, the SEC significantly walked back the proposals in the final rules, eliminating the requirement to disclose financial impact metrics entirely and focusing instead exclusively on expenditure metrics relating to severe weather events and other natural conditions.

However, despite commenters arguing that pegging the disclosure requirements to an arbitrary quantitative threshold was inconsistent with existing materiality precedent of both the U.S. Supreme Court and the SEC and would result in excessive immaterial disclosure (and despite the SEC’s addition of materiality qualifiers in numerous other parts of the final rules in response to feedback on the proposal), the SEC doubled down and included a 1% threshold for expenditures, albeit with respect to a more limited set of denominators and de minimis exceptions. While the removal of the financial impact metrics is an extremely welcome change that will significantly ease the burden on registrants of complying with the final rules, what remains may still present challenges with respect to interpretation and implementation, as well as result in immaterial disclosure in the financial statements that is untethered from the disclosure that will be produced pursuant to the remainder of the final rules.

As explained in more detail below, the final rules also require registrants to provide certain contextual information relating to these expenditure metrics, disclose certain expenditures relating to its use of carbon offsets and renewable energy credits (RECs) and describe whether the estimates and assumptions used to prepare the financial statements were materially impacted by exposures to risks and uncertainties associated with, or known impacts from, severe weather events and other natural conditions.

The final rules no longer include provisions for voluntary disclosure from registrants of the impact of climate-related opportunities to their financial estimates and assumptions, since the related proposed requirements to disclose financial impact metrics and costs and expenditures related to transition activities were removed. However, registrants must disclose, in the narrative disclosure required by subpart 1500 of Regulation S-K, quantitative and qualitative information about material expenditures related to mitigation of or adaptation to climate-related risk (in management’s assessment), disclosed transition plans and disclosed targets and goals.

B. Final Rules – Summary

1. Expenditures and Capitalized Costs Related to Severe Weather Events and Other Natural Conditions (Rules 14-02(b), (c), (d), (f) and (g))

The final rules require registrants to disclose:

- Expenditures expensed and losses

- The aggregate amount of expenditures expensed as incurred and losses,[4] excluding recoveries, incurred during the fiscal year as a result of severe weather events and other natural conditions.[5],[6]

- Disclosure is required if such expenditures and losses[7] exceed 1% of the absolute value of the registrant’s income or loss before income tax expense or benefit (with a $100,000 de minimis exception).

- Registrants must separately identify where in the income statement these expenditures and losses are presented.

- Capitalized costs and charges

- The aggregate amount of capitalized costs and charges,[8] excluding recoveries, recognized during the fiscal year as a result of severe weather events and other natural conditions.[9]

- Disclosure is required if the absolute value of such costs and charges exceed 1% of the absolute value of stockholders’ equity or deficit, at the end of the relevant fiscal year (with a $500,000 de minimis exception).

- Registrants must separately identify where on the balance sheet these costs and charges are presented.

Rule 14-02(f) requires that, as part of the contextual information required pursuant to Rule 14-02(a) discussed below, a registrant must separately include the aggregate amount of recoveries, such as insurance proceeds, recognized during the fiscal year as a result of severe weather events and other natural conditions for which expenditures, losses, costs and charges are disclosed pursuant to the final rules.

Rule 14-02(g) provides an attribution principle that specifies that for the purpose of the final rules, a capitalized cost, expenditure expensed, charge, loss or recovery results from severe weather events and other natural conditions when the event or condition is a “significant contributing factor” in incurring such cost, expense, charge, loss or recovery and that the entire amount of such item must be reflected.

2. Carbon Offsets and RECs (Rules 14-02(e) and (f))

If carbon offsets or RECs have been used as a material component of a registrant’s plan to achieve its disclosed climate-related targets and goals, the registrant must disclose the aggregate amounts of:

- Carbon offsets and RECs expensed;

- Capitalized carbon offsets and RECs recognized; and

- Losses incurred on capitalized carbon offsets and RECs, in each case during the relevant fiscal year.

Once a registrant concludes that carbon offsets or RECs have been a material component of its plan, disclosure of these amounts is not subject to any quantitative threshold or de minimis exception. If a registrant is required to make these disclosures, it must disclose where on the balance sheet and income statement the capitalized costs, expenditures expenses and losses incurred related to carbon offsets and RECs are presented. It must also state its accounting policy for carbon offsets and RECs as part of contextual information disclosed to describe how the financial statement effect was derived. In addition, a registrant is also required to disclose beginning and ending balances of capitalized carbon offsets and RECs for the fiscal year.

3. General Instructions (Rules 14-01(a)-(c))

Registrants are required to include financial statement footnote disclosure pursuant to Article 14 in any filing that is required to include disclosure pursuant to subpart 1500 of Regulation S-K and that also requires a registrant to include its audited financial statements. The disclosure must be included in a note to the financial statements, and use financial information and apply the same accounting principles as its consolidated financial statements included in the filing. The definitions of subpart 1500 of Regulation S-K apply to Rules 14-01 and 14-02, except where otherwise indicated.

4. Periods to be Disclosed (Rule 14-01(d))

Disclosure must be provided for the registrant’s most recently completed fiscal year and, only to the extent such disclosure was previously disclosed or required to be disclosed, for any historical fiscal years for which audited consolidated financial statements are included in the filing.

5. Contextual Information (Rule 14-02(a))

Registrants must provide certain contextual information, describing how each specified financial statement effect disclosed under Rule 14-02(b)-(h) was derived, including a description of significant inputs and assumptions used, if applicable, policy decisions made by the registrant to calculate the specified disclosures and, in a change from the initially proposed rules, significant judgments made and other information that is important to understand the financial statement effect.

6. Financial Estimates and Assumptions (Rule 14-02(h))

Registrants must disclose whether the estimates and assumptions used to prepare the consolidated financial statements were materially impacted by exposures to risks and uncertainties associated with, or known impacts from, severe weather events and other natural conditions or disclosed targets or transition plans.

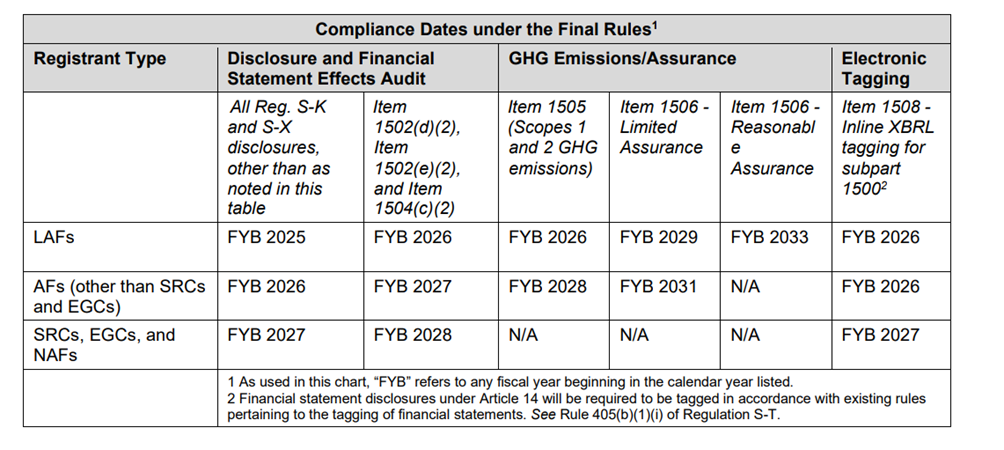

7. Compliance Timeline

While the final rules adopt staggered and delayed compliance dates based on the filing status of the registrant, all disclosures under Article 14 must be included in the filings made by the registrant in its initial year of compliance. The compliance dates can be found in the table below. Under the final rules, smaller reporting companies (SRCs), emerging growth companies (EGCs) and non-accelerated filers (NAFs) have a longer phased-in compliance period than large accelerated filers (LAFs) and accelerated filers (AFs), giving them more time to prepare to comply with the final rules.

Interestingly, the SEC adopted a phase-in period that allows a registrant an additional year after its initial compliance date to comply with the requirement to disclose, quantitatively and qualitatively, the material expenditures incurred and material impacts on financial estimates and assumptions resulting from climate-related risks, disclosed transition plans and targets or goals under Regulation S-K. However, despite the fact that disclosures under Article 14 may raise similar complexities for registrants in terms of updating reporting systems, and will be subject to audit and ICFR review, the SEC did not granted a similar phase-in period for the Article 14 disclosures.

C. Final Rules – Discussion and Analysis

1. The One Percent Threshold

Despite the suggestions of many commenters that financial statement footnote disclosure be required only if material or, failing that, at a higher threshold (e.g., 5% or 10%), the final rules retain the proposed 1% threshold (subject to the above noted de minimis exceptions). The SEC maintained in the adopting release that a 1% threshold is appropriate as it provides registrants with greater clarity in implementing the final rules, reduces the risk of underreporting and increases consistency and comparability.

As initially proposed, registrants would have been required to disclose expenditures and capitalized costs equaling 1% or more of total expenditures expensed or total capitalized costs. In the final rules, the SEC changed the denominators to 1% of income or loss before income tax expense (in the case of expenditures expensed and losses) or 1% of total stockholders’ equity or deficit (in the case of capitalized costs and charges), on the grounds that these are well known and understood by investors and easily calculable.

Nonetheless, the 1% disclosure threshold remains inexplicably low, and its retention is at odds with the SEC’s general approach to the requirements under new Regulation S-K Item 1500, where the final rules liberally added materiality qualifiers as compared to the proposal.[10] The result is that registrants may be required to include financial statement disclosure of expenditures relating to events that the registrant does not consider material and therefore would not be required to address elsewhere pursuant to the final rules.[11] Conversely, it is also possible that a given event or condition could have a material impact on a registrant due to lost revenues, which would elicit disclosure elsewhere but not necessarily pursuant to new Article 14. The fact that registrants are not permitted to net recoveries, but must instead include those in the contextual narrative disclosure, is likely to compound the problem while providing little additional benefit to investors, for whom the most important factor is likely the net financial impact.

The use of income or loss before income tax expense as the denominator for calculating the 1% threshold for income statement items is a particularly curious choice. The SEC reasoned in the adopting release that because the denominators used for the 1% threshold in the final rules are aggregated amounts (rather than disaggregated line items as proposed), they should not result in an excessive amount of detail or immaterial disclosure because in many instances they will result in a larger denominator than what would have been used under the proposed rules. However, the SEC itself has previously acknowledged that using net income as a denominator for calculating when a disclosure threshold is tripped can result in anomalous results for registrants with marginal or break-even net income or loss in a given year.[12]

Overall, the final rules could result in arbitrary and confusing disclosure that may be inconsistent both between registrants and for any given registrant from year to year. For example:

- Registrants who regularly report a small amount of net income will likely need to include disclosure far more frequently than those with ongoing significant net losses.

- A registrant that settles an unrelated litigation or completes a restructuring in a given fiscal year may well be required include disclosure, even if its revenue remained consistent and more significant severe weather events or other natural conditions did not trip the 1% threshold in prior years.

- Whether a given registrant needs to include disclosure relating to severe weather events or other natural conditions of similar significance may turn on whether the event happens early in a fiscal year (such that most expenses and costs are recognized during a single fiscal year) or later in the year (such that expenses and costs are split over two years).

The SEC also acknowledged that because the balance sheet and income statement 1% thresholds are separate, it is possible that one may be tripped while the other is not, which could provide an incomplete picture of the impact on the financial statements of a given event or condition. The SEC noted that registrants are not prohibited from disclosing impacts on both the balance sheet and income statement even if 1% is not reached for both, but expecting registrants to include additional disclosure to accommodate an incomplete picture painted by a low quantitative disclosure threshold is an unsatisfying result, and not a path registrants are likely to go down if they view the impacts as immaterial.

2. Defining Severe Weather Events and Natural Conditions

While the SEC clarified in the adopting release that registrants are not required to determine whether a severe weather event or other natural condition was caused by climate change, it declined to provide additional guidance on whether a given event or condition would be captured by the final rules and instead provided a list of examples of events or conditions that is neither exclusive nor exhaustive.[13] The adopting release maintains that a registrant will have the flexibility to determine what constitutes a “severe weather event” or “other natural condition” based on the particular risks it faces, taking into consideration its geographic location, historical experience and the financial impact of the event, among other factors.

The SEC reasoned that the removal of any ambiguity around whether an event or condition needs to be caused by climate change would simplify matters, but registrants will still face challenges in determining whether a given occurrence constitutes a severe weather event or other natural condition under the final rules given the number of factors to be considered. This is also likely going to be a particularly challenging area for auditors to review, and registrants will need to work closely with their auditors to develop consistent policies and procedures for evaluating whether a given event or condition is “severe.”

The ambiguity around which types of events or conditions constitute a “severe weather event or other natural condition” is another area that may well lead to inconsistent disclosure across registrants, as it is likely that different registrants will come to different conclusions around whether the same events or conditions are severe (either because of different interpretation of historical patterns, or varying impacts of the underlying event). This is likely to result in a lack of comparability—a problem the SEC acknowledged, but ultimately concluded was preferable to more prescriptive approaches that would reduce variation.

Additionally, the fact that an event or condition does not need to be related to climate means that the scope of events that elicit disclosure in the financial statements is going to be different than the types of physical risks that a registrant identifies for purposes of disclosure under the amendments to Regulation S-K (i.e., acute risks (including severe weather events and other natural conditions) and chronic risks). This potential divergence is highlighted by a footnote in the adopting release, which notes that since the “natural conditions” referenced in the final rules need not be climate-related, they may therefore include types of non-climate-related occurrences, such as earthquakes – a rather casual reference to something that is typically thought of as an entirely different class of natural disaster and that almost certainly will not be captured by any registrants in their climate-related disclosure under new Regulation S-K. The inclusion of the impact of both climate-related and non-climate-related events under Regulation S-X may be confusing, especially when disclosure requirements elsewhere are limited to climate-related events and conditions, and may even reduce investors’ ability to assess the actual financial impact of climate change on a registrant.

As with some of the complexities resulting from the thresholds described above, the narrative contextual disclosure provided pursuant to the final rules may help alleviate some of this confusion and, over time, may limit inconsistency between registrants as the market coalesces around certain disclosure practices. However, once again, this will require a lot of ink being spilled to clarify and contextualize disclosure that registrants and investors may consider immaterial in the first place.

3. Applying the Attribution Principle

In response to concerns about the ability of registrants to quantify expenditures related to severe weather events and other natural conditions, the final rules include a principle for attribution, requiring that registrants must attribute and disclose the entire amount of a cost or expenditure related to a severe weather event or other natural condition if the event or condition is a “significant contributing factor” in incurring such cost or expenditure. When making such attributions, registrants are required to use the same accounting principles used to prepare their audited financial statements.

In the adopting release, the SEC acknowledges that application of the attribution principle is a matter of judgment, as it will require financial statement preparers to make determinations about whether a severe weather event or other natural condition meets the concept of significance. In many cases, such attribution may be clear and easily discernible by the registrant. The SEC provides the example of a tornado damaging the roof of a registrant’s factory and notes that in that scenario, the tornado would be considered a significant contributing factor in the costs incurred to repair the roof, and the registrant would be required to disclose the entirety of such costs even if there could be other factors that contributed to the roof’s condition after the damage incurred from the tornado. However, there are many situations that will be less clear-cut, especially when impacts are not directly to property or operations owned and maintained by the registrant. For example, if a significant supplier cannot deliver necessary parts on time and a registrant is forced to find an alternative source at the last minute for double the cost, the registrant would likely need to consult with the supplier in order for the registrant to come to a definitive conclusion around whether a severe weather event or other natural condition was a significant contributing factor in their failure to deliver and incurrence of resulting expenses. Additionally, the requirement to include the entire expense in the financial statement note would likely overstate the impact of such event if the original supplier refunded (or had not yet charged) the registrant.

This is another area that is likely to be challenging for auditors to review, and again registrants will want to work with their auditors early on, in order to establish consistent policies and procedures for how to apply the attribution principle.

4. Carbon Offsets and RECs

As adopted, this disclosure requirement fortunately has its roots in materiality and ties more neatly to disclosure that will be required pursuant to the amendments to Regulation S-K. Under Item 1504(d) of Regulation S-K, if carbon offsets or RECs are used as a material component of a registrant’s plan to achieve its climate goals or targets, the registrant must also disclose in its narrative disclosure outside the notes to the financial statements the amount of carbon avoidance, reduction or removal represented by the offsets as well as the amount of generated renewable energy represented by the RECs. In addition, registrants must also disclose the nature and source of the offsets or RECs including a description and location of the underlying projects, any registries or other authentication of the offsets or RECs and the cost of the offsets or RECs. As noted above, if disclosing carbon offsets or REC’s that are material to the registrant’s plan, the registrant will need to include in the notes to the financial statements the specified expenditure metrics that show the financial statement impacts of these same carbon offsets and RECs, without regard to any quantitative thresholds or de minimis exceptions.

Since registrants that use carbon offsets and RECs already account for any impact they have on their financial statements under current rules, the difficulty in implementing the final rules is likely to be in evaluating whether those offsets or RECs are used as a material component of the registrant’s plan. Once that decision is made, the financial statement disclosure should be relatively straightforward and will complement the picture painted by the disclosure required by Regulation S-K.

5. Historical Periods Presented

Disclosure of historical periods under the final rules is required only on a prospective basis, representing a very welcome change from the initial proposal, which would have required a registrant to provide disclosure for the most recent fiscal year and the prior historical fiscal years included in the registrant’s audited consolidated financial statements in the applicable filing, even if the registrant had not previously provided disclosure for those years pursuant to Article 14. This change will also significantly ease the burden on companies planning to go public, as they will only have to include information with respect to their most recent fiscal year in their initial registration statement.

II. Key Takeaways and Next Steps

While the fate of the final rules remains uncertain, litigation and politics-based changes may take time, and ultimately there may be not changes to the final rules or the implementation timeline. In light of that uncertainty, registrants should continue to monitor the status of the final rules as they take steps to prepare for ultimate implementation. Some key takeaway and areas registrants may want to focus on include:

- Establish Policies and Procedures. Registrants should work to establish clear policies and procedures for the determination of whether a severe weather event or other natural condition has occurred, and whether the event or condition has been a “significant contributing factor” in incurring an expenditure or recovery.

- To ensure consistent disclosure and facilitate review by external auditors, registrants will want to make sure that they have guidelines in place addressing how these questions will be evaluated well before any event that could require disclosure occurs.

- Registrants whose operations or financial condition have previously been impacted by events that could fall into these categories should consider reviewing historical patterns and past impacts with a view toward establishing internal baselines for what would constitute a severe weather event or natural condition in the future, based on such registrants’ particular facts and circumstances.

- Plan to Track All Expenditures and Costs. Although the inclusion of de minimis exceptions in Rule 14‑02(b) may be helpful at the margins, in practice the extremely low numbers are likely to be of little use to many registrants. In light of the 1% threshold and the requirement for all of a registrant’s expenditures and costs relating to all severe weather events and other natural conditions to each be aggregated over a given fiscal year, in practice registrants will likely want to track all expenditures and costs that could be potentially captured by the final rules as they are incurred.

- Even though a registrant may be confident that expenditures and costs relating to a severe weather event occurring early in the year will be either well below the applicable 1% thresholds or the de minimis exceptions, another more significant event or condition later in the year could ultimately require aggregation of earlier expense and costs. Tracking all potentially relevant expenses and costs as they are incurred will enable registrants to avoid a scramble in the event of last-minute surprises.

- This will particularly important for registrants that generally report a marginal or break-even net income or loss or frequently experience what could constitute a severe weather event or other natural condition.

- Although the SEC reasoned that registrants are likely to have insight into where their income or loss before income tax expense or benefit and stockholders’ equity or deficit will end up before the end of the year, it is possible unexpected events late in the year could significantly move the needle such that expenditures that were expected to be well below the 1% threshold are not.

- ICFR. Registrants will need to build these new requirements into existing ICFR, including setting up methodologies and guidelines around new critical accounting policies, use of estimates and areas of uncertainties that should be explained.

- Auditors. Registrants should engage with internal audit and independent auditors early and often to ensure alignment of expectations around climate-related financial statement disclosure and the related audit process, particularly in light of these changes from the proposed rules.

- Audit Committee. Registrants should prepare their audit committees for the added responsibilities of having to review the climate-related financial expenditure and estimates and assumptions disclosure pursuant to the final rules, and consider how to navigate the added workload on committee members.

[1] For a more detailed timeline of compliance dates for the final rules, see below in Section I.B.7.

[2] The final rules are set forth in the SEC’s March 6, 2024 release, available here.

[3] However, the final rules do not apply to registered investment companies, asset-backed issuers, Canadian registrants that are Multijurisdictional Disclosure System (MJDS) filers or sovereign issuers.

[4] Although the original proposal did not include losses or charges as expenditure metrics required to be disclosed, the SEC noted in the adopting release that disclosure of these items would have been required under the proposed financial impact metrics and so inclusion in the final rules for expenditures is not an expansion of scope.

[5] While the final rules provide examples of events and conditions that may be “severe weather events or other natural conditions,” these terms are not defined. See further discussion below in Section I.B.2.

[6] For example, a registrant may be required to disclose the amount of expense or loss, as applicable, to restore operations, relocate assets or operations affected by the event or other natural condition, retire affected assets, repair affected assets, recognize impairment loss on affected assets, or otherwise respond to the effect that severe weather events and other natural conditions had on business operations. See Rule 14-02(c).

[7] As noted in the adopting release, in contrast to capitalized costs and charges, “[e]xpenditures expensed as incurred and losses in the income statement do not offset one another and therefore the use of absolute values is unnecessary to determine whether the applicable disclosure threshold is triggered.” See adopting release at 470.

[8] See footnote 4 above.

[9] For example, a registrant may be required to disclose the amount of capitalized costs or charges, as applicable, to restore operations, retire affected assets, replace or repair affected assets, recognize an impairment charge for affected assets, or otherwise respond to the effect that severe weather events and other natural conditions had on business operations. See Rule 14-02(d).

[10] Similar comments have been made by the SEC Commissioners who dissented in the vote approving the final rules. See, for example, Remarks of Mark T. Uyeda at the “SEC Speaks” Conference 2024 (stating that the “fundamental flaw” of the final rules is that they require “disclosures not financially material to investors” and that “[t]he significant changes in the final rule reflect a recognition that no disclosure rule that veers from materiality is likely to survive a court challenge”), available here.

[11] For example, new Regulation S-K Item 1502(a) requires registrants to “[d]escribe any climate-related risks that have materially impacted … the registrant, including … its … results of operations, or financial condition” and Item 1502(d)(1) requires registrants to further discuss how such risks “have materially affected … the registrants … results of operations, or financial condition” (emphasis added).

[12] In 2020, the SEC added a revenue component to the “Income test” under Rule 1-02(w) of Regulation S-K in order to mitigate the potential for immaterial disclosure when testing significance using only net income. See Amendments to Financial Disclosures about Acquired and Disposed Businesses, Release Nos. 33-10786; 34-88914, available here.

[13] The examples provided of severe weather events and other natural conditions include hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures and sea level rise.